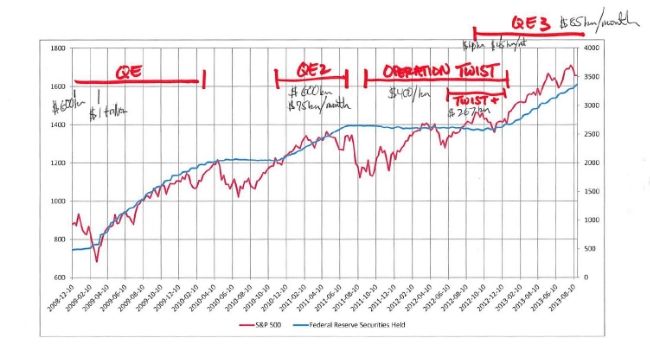

Ever since Ben Bernanke mentioned tapering, investors have been worried about the implications on their portfolios.

When you look at the chart above, there is no question that the stock market has been a beneficiary of Bernanke's massive expansion of the Fed balance sheet. When QE1 and QE2 ended, the stock market violently reacted to the downside. Now just the mention of tapering has many participants shaking in their boots. Should you be worried?

Here are 3 reasons why you shouldn't fear the taper:

1) Tapering is not tightening. Tapering hasn't even started and even by most economists predictions, the initial taper will only be $10 billion less in asset purchases per month by the Fed. This means that the Fed is going from $85 billion/month down to $75 billion in purchases of Treasuries and mortgage backed securities. This isn't an end to QE yet, it is a slowing. Overall monetary policy will remain accommodative.

2) It doesn't make sense for the Fed to continue buying $45 billion/month in Treasury securities. Since the sequester, the government has been spending less and therefore issuing less debt so there is no need for the Fed's continued buying at the same pace. US government debt has increased by $305 billion year to date while the Fed is on pace to purchase $360 billion through the end of August. I would guess that the Fed will continue to purchase mortgage backed securities while slowing their Treasury purchases.

3) Since 2008, the market has become too reliant on Fed intervention. In the past, the economy and stock market thrived without such intervention from the Fed and it is healthier in the long-term for the markets to grow organically.