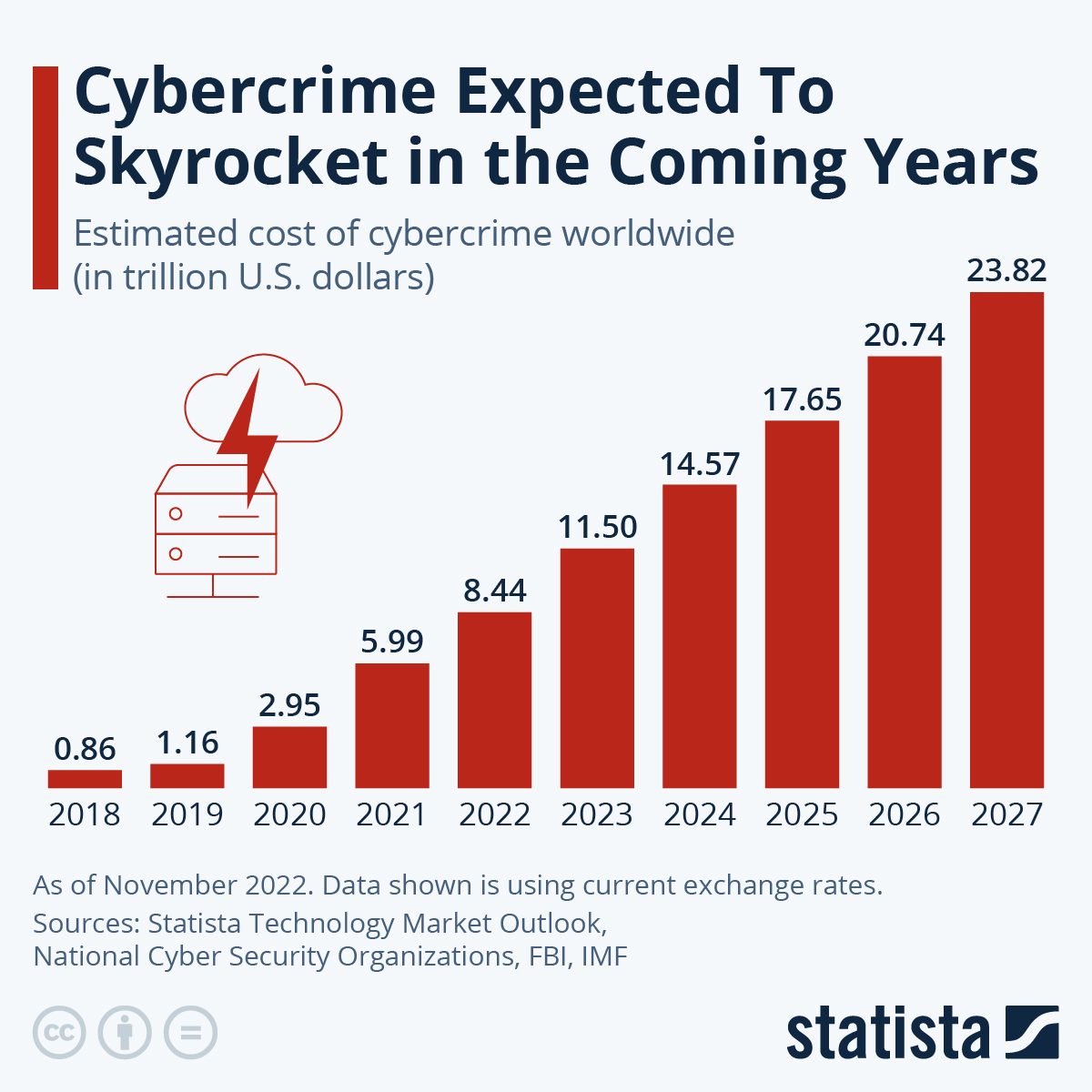

Today I wanted to share a PSA on protecting your brokerage account. According to the FBI, the global cost of cybercrime is expected to surge in the next five years. This trend is corroborated by cybersecurity experts at banks and brokerage firms. When it comes to online crime and identity theft, an ounce of prevention is worth a pound of cure.

We wrote about this subject almost 10 years ago in a blog post entitled “3 Steps to Protect Your Brokerage Account from Cybercriminals.” There we discussed the hostile email account takeover and how to protect against it.

Since then, criminal activity has only gotten worse, and much of our personal information may already be on the black market because of hacks at Experian and other major retailers.

We recently heard a story from another advisor where a criminal was able to access a client's online brokerage account; opened a new account; and then made an IRA distribution to the new account. Luckily this was caught before any money was transferred and the accounts were locked down.

Locking Your Front Door

- Enable Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security to your account by requiring a second form of verification beyond your password. This typically involves receiving a one-time code on your phone or email that you need to enter along with your password when logging in. Enable 2FA on your brokerage account to make it significantly more challenging for unauthorized individuals to gain access, even if they somehow acquire your password.

- Use Strong and Unique Passwords: Creating strong, unique passwords is vital for all your online accounts, but especially for your accounts at financial institutions. Avoid using easily guessable information such as birthdays, names, or common words. Instead, use a combination of uppercase and lowercase letters, numbers, and special characters. Additionally, ensure that each online account has a distinct password, so that if one account's password is compromised, the others remain secure.

- Regularly Monitor Account Activity: Keep a close eye on your brokerage account's activity by reviewing statements, trade confirmations, and transaction history regularly. If you notice any unfamiliar or suspicious transactions, report them immediately to your brokerage firm. Regular monitoring allows you to spot potential security breaches or unauthorized access early on and take appropriate action.

Feature image from Unsplash