I am just a few days from heading home after a much needed vacation to the beautiful Riviera Maya. A visit to Cancun and Playa del Carmen can do wonders for your soul. Time to rest and relax with family – sip on frozen drinks and think about investing. So what lessons can be learned from my time at the beach? Here are the top 5 investing lessons from my vacation in Mexico.

1) Do your own homework

When investing or planning a trip, you have to do your own homework. After happily booking our holiday, we told people we were headed to Cancun. At least three people warned us of violence in Mexico. They read too many sensationalist headlines and didn't read the substance behind them. Don't fall into the same trap with your investments. Turn off CNBC! The screaming and yelling won't lead to good decisions.

2) Forecasting is tricky

When my plane touched down in Cancun, it was humid and the skies were cloudy. On the taxi ride to the hotel, it was pouring rain. For the next two days, we suffered through monsoon type rains. We checked The Weather Channel and the forecast called for 70-100% rain every day for the next 10 days! It was the worst weather forecast I had ever seen. I checked Tripadvisor forums to find people were considering canceling their travel plans in the face of such dire forecasts. My wife and I also wondered if we should cut our trip short. What is a beach holiday in torrential rains? Luckily, we took a breath and waited. The next day was overcast but no rain. And the day after was sunny, and we have had great weather ever since. Lesson learned: forecasting is tricky. Wall Street is no different. Strategists missed the mark so badly in 2013 that they had to revise their S&P price targets by the end of the 1st quarter of 2013.

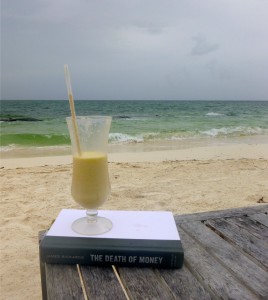

3) Beach reading

When lounging on the beach, you have to have a great book to read. My choice for this trip: Jim Rickards‘ The Death of Money: The Coming Collapse of the International Monetary System. His books should be read by all investors, and I also highly recommend his best seller Currency Wars. Things are playing out much like he predicted as the Euro and Dollar are being burnt to the ground by central planners. While I was pondering the death of money, the ECB made the first move to negative interest rates. So much for the strong European recovery. When the US economy starts slowing, Yellen will likely follow suit in a race to the bottom. This can't end well for anyone. Rickards suggests owning gold for protection.

4) Starbucks is pretty awesome

Starbucks is pretty awesome. Simple fact. Right across from my hotel in a touristy mall, there is a Starbucks and a Teavana. Yes, they will likely dominate tea as they do in coffee. I visited both but since it was so hot, I stuck with an iced coffee. No need for cash, I used my iPhone Starbucks app to pay. Today the company announced that stores will offer free wireless charging for your cell phone. Talk about great service. Starbucks is second to none.

5) Don't get burned

Enjoying the beach and sun are the key reasons to visit Cancun. But if you stay out in the sun too long, you can easily get burned. Especially on those days when the clouds keep the sun at bay, you get complacent and forget to apply the suntan lotion. These days, the volatility gauge, VIX, is reading extraordinarily low. Are investors getting too complacent in the bull market that is over 5 years old? Be sure that your stocks don't get burned. Know when to de-risk and know when it is time to sell and book some profits.

Well that's it for now. One more frozen drink for me… Happy investing!

By