Last week, the Dow closed at an all-time high and the S&P 500 traded very close to its historic high. For investors glancing at the headlines, all seems fine and dandy. It's like sailing a boat with beautiful skies and perfect wind conditions. However storm clouds may be right around the corner. Everything isn't signaling a raging bull market, that is for certain.

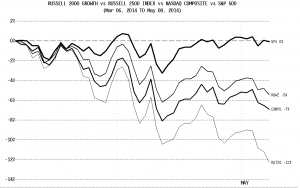

Since March 6th, we have spotted a very troubling divergence in the markets. While the S&P and Dow trade near the highs, there is volatility building in Nasdaq and small cap names. It is a troubling sign when the high momentum stocks start to crash and burn. In the chart below, you can see that midcaps, small caps and tech stocks are all trailing the S&P. Small cap growth stocks are down over 12%!

In a recent CNBC article, traders, strategists and technicians are warning it might be a good time to play it cautiously. “You have the Dow and the S&P within a percent of their all-time highs. You've got social, internet, biotechs and small caps struggling to hold their 200 days. That's a big disconnect. That's got traders on edge,” said Scott Redler of T3Live.com.

Sam Stovall, chief equity strategist at S&P/Capital IQ, is also worried. “My feeling is it's a signal of caution. The big blue chips tend to fall after everybody else has retreated.”

“Nothing is always, but I would tend to say that is a big concern for investors,” he said, noting the S&P is up a percent for the year and the Dow is basically flat. “You could almost think of the large cap stocks as treading water, but they are tethered to the small and mid-cap issues and if those issues sink, it will be very hard for the large caps to stay afloat.”

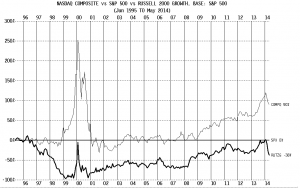

I will leave you with one more chart. The Nasdaq and Russell 2000 Growth Indices are in a similar position to the peak of the 2000 bubble. The Fed has inflated the same bubble once again (though not quite as large) and it may very well have begun to pop.

Do you think this is the beginning of the bear market? Or is it just a breather in the bull market?

By