This morning the Dow fell another 355 points, making it a total two day loss of 1000 points. Sure that's a big drop but in percentage terms it is fall of 4%, but keep in mind that the Dow is still up 2% on the year and up 25% since a year ago.

Volatility is normal

Last year, the market lulled investors into a abnormal universe of no volatility. It was the one of the least volatile year on record. It is important to remember that this isn't what investors should expect and apparently now just a little volatility causes increased stress about market losses. The S&P just broke a streak of 311 trading days without a 3% drop – the previous streak was 241 days. The S&P still has its record streak of 404 trading days without a 5% pullback intact for now. I wouldn't be surprised to see that streak broken in the next few days.

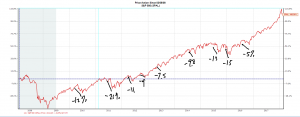

This chart shows just some of the pullbacks in the bull market since 2008. You can see almost every year, there is a drop of at least 7-10 percent. This is the norm, not the exception. No investor should expect a repeat of 2017 and the record low volatility. Like I said in our quarterly conference call in early January:

“It's a pretty safe bet that we will see volatility increasing. I don't think it will be dramatic, but you can always have a 5-10% pullback in a bull market and it would be viewed as nothing unusual.”