Runnymede has increasingly been serving as a fiduciary advisor to companies' 401(k) plans so I will be writing a series of articles on how to tune up your retirement plan. The intended audience is the company and its trustees that sponsor the plan but participants are also advocating for better plans. It is our hope to help employers optimize and better manage their retirement plan. In doing so, we seek to help employees achieve their goal of successfully preparing themselves for retirement.

What is 401(k) Plan Benchmarking?

Benchmarking your plan means going through a process to see how your plan compares with others of similar size and/or type. Often, you will be able to measure participant metrics (savings and investing) and quantify the fees you are paying in order to determine whether those expenses are reasonable.

Why Benchmark Your Plan?

Whether your plan is new or old, plan sponsors are benchmarking their plans more regularly due to concerns of 401(k) lawsuits and fiduciary responsibility. Here are reasons to benchmark your plan.

- Meet your fiduciary responsibilities under ERISA

Under ERISA, the trustee or trustees of a retirement plan have a fiduciary duty to its participants. This duty requires monitoring and benchmarking service providers to ensure that fees are reasonable and service providers are performing as they should. Note that it is not only important to engage in this process but to document your actions. Failing to do so could result in fines and class action lawsuits. - Save your company and participants money

The law requires fees charged to a 401(k) plan to be “reasonable” rather than specifically defining what is permissable. This puts the burden on plan trustees to determine what is reasonable so benchmarking is a great way to do that. Find out what you are paying in plan expenses and then compare your expenses to other similar plans in terms of asset size, number of participants, and the employer's industry. - Improve your service providers

Most companies' 401(k) plans grow over time through participant and employer contributions and market appreciation. Too often, service providers do not adjust fees to account for this growth. In some cases, a plan that was once a start-up plan may even outgrow its original service providers and need to find new service providers that can offer better features and lower costs. Benchmarking your plan is a good way to keep your current service providers in check and see if you need to shop for new ones. - Improve plan design and features

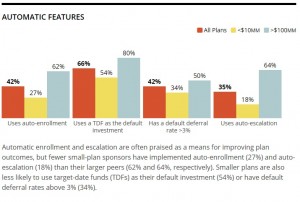

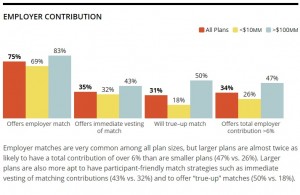

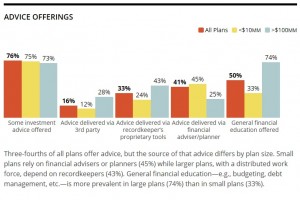

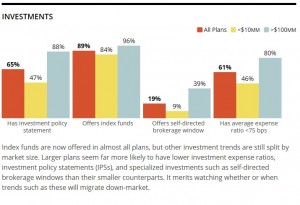

Benchmarking and reviewing your plan is a great time to also examine if updates are needed to your plan document, plan structure, and plan design. Employers should seek to find ways to increase participation using features like auto enrollment and auto escalation. Perhaps, your fund lineup does not include common best practices like low cost index fund choices or target date funds.

DIY: Getting Started with Benchmarking Data

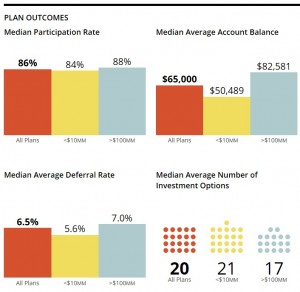

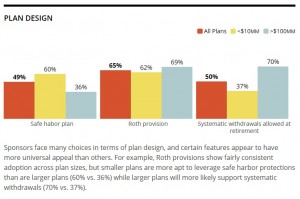

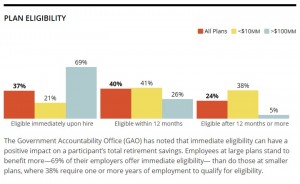

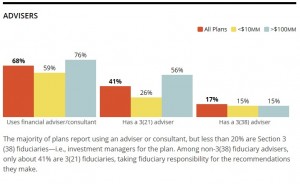

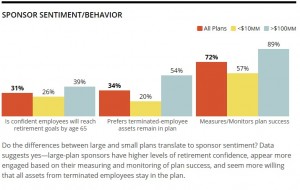

PLANSPONSOR recently published the findings of its annual 2016 PLANSPONSOR DC Survey: Plan Benchmarking. This is a great place to start to provide you with context when reviewing your own plan. Not only can you compare your plan, but the survey can guide you in what areas to look at.

Here are selected highlights:

Still Need Help?

Contact one of our advisers and we'd be happy to point you in the right direction. If you want to learn more, consider watching my on-demand webinar where I highlight mistakes to avoid and specific improvements that you should check for in your plan.

When was the last time you benchmarked your company's 401(k) plan? Did you get help from a retirement specialist or did you do it yourself?

“401K” by Got Credit is licensed under CC BY 2.0

By