In this episode of the Inspired Money Live Stream Podcast, we discuss classic cars as retirement investments, an alternative asset class gaining attention for its financial potential and emotional rewards. Our panel of experts includes Leslie Kendall, Chief Historian at the Petersen Automotive Museum, Phillip Griot, President and CEO of Griot’s Motors, and Andrew Shirley, creator of the Knight Frank Luxury Investment Index. Together, they share their expertise on market trends, valuation strategies, and maintenance essentials.

Inspired Money Livestream Podcast

Classic Cars as Retirement Investments: Driving into the Golden Years with Style

Understanding the Allure of Classic Car Investments

Classic cars combine financial potential with personal satisfaction, making them an attractive choice for retirement investments. Unlike traditional assets, these vehicles carry a rich history and cultural significance, offering long-term appreciation and emotional connection.

This episode covers everything from selecting the right vehicles to understanding the risks involved. Whether you’re a collector or a first-time investor, these insights can help you navigate this exciting market.

🕒 Episode Insights

Financial Benefits of Classic Cars

Classic cars have shown steady returns over time. Andrew Shirley explains how these vehicles consistently rank high on the Knight Frank Luxury Investment Index, driven by rarity, craftsmanship, and historical value.

Key trends include:

- The rising popularity of 1980s and 1990s models, reflecting generational shifts.

- Increased demand for limited-production cars with strong provenance.

- How cultural touchpoints, like appearances in movies or TV shows, enhance a car’s value.

Key Criteria for Investment

Leslie Kendall emphasizes the importance of originality and historical significance when selecting vehicles. Phillip Griot highlights the value of low-production models and timeless designs, which tend to perform well in the market.

Examples of popular investment models include:

- Jaguar E-Type: Known for its iconic design and engineering excellence.

- Ferrari 308 GTB: Gaining recognition for its blend of style and performance.

- Porsche 911: A classic that continues to attract strong demand across generations.

Maintenance and Preservation

Proper maintenance is critical for preserving the value of classic cars. Phillip Griot advises prioritizing climate-controlled storage and professional servicing. Leslie Kendall stresses that maintaining originality, rather than over-restoring, is key to maximizing returns.

Essential practices include:

- Regular inspections to address wear and tear.

- Proper storage to protect against environmental damage.

- Using trusted professionals for repairs and restoration.

Neglecting maintenance can lead to diminished returns, making it essential to prioritize care.

Emotional Rewards of Ownership

Classic cars offer more than financial returns—they provide a sense of pride and connection to history. Owners often find joy in driving their vehicles, attending shows, and building relationships within the car enthusiast community.

Phillip Griot shares stories of retirees who turned their passion for cars into fulfilling hobbies, creating memories while preserving automotive history.

Risks to Consider

While classic cars are a rewarding investment, they come with unique challenges. Maintenance costs, market volatility, and restoration pitfalls can impact returns.

The panel emphasizes the importance of working with trusted experts and conducting thorough due diligence. Balancing passion with a clear investment strategy can help mitigate these risks..

Building a Balanced Portfolio

Classic cars are a valuable addition to a diversified portfolio, offering financial growth alongside personal enjoyment. As Andrew Shirley notes, these vehicles transcend generations, making them both a legacy and an investment.

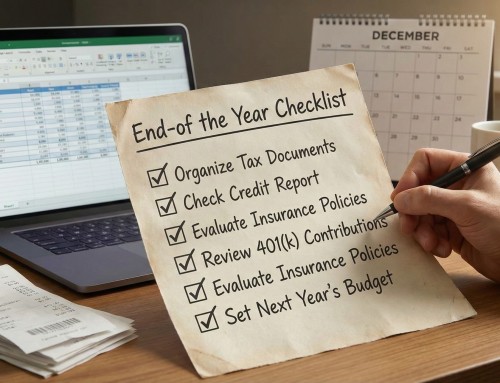

This episode provides actionable insights for balancing your portfolio with alternative assets like classic cars, watches, and fine wines.

Meet Our Guest Panelists

- Leslie Kendall

Chief Historian at the Petersen Automotive Museum, Leslie oversees one of the world’s most comprehensive automotive collections. His expertise provides deep insights into the cultural and financial significance of classic cars.

Visit Petersen Automotive Museum - Phillip Griot

President and CEO of Griot’s Motors, Phillip specializes in car restoration, consignment, and collector car storage. His practical advice helps investors maximize returns while enjoying their vehicles.

Discover Griot’s Motors - Andrew Shirley

Director at Knight Frank and creator of the Knight Frank Luxury Investment Index, Andrew offers expertise on passion assets, tracking trends across classic cars, fine art, and more.

Explore Knight Frank Insights

Join the Conversation

This blog post is brought to you by Runnymede Capital Management, in collaboration with EaglesVision and the Inspired Money live-stream podcast series. Learn how to diversify your portfolio with alternative investments in classic cars, watches, and fine wines.