Captive Investing Today

Since the financial crisis began in 2007, the Federal Reserve has taken extraordinary actions including reducing the level of short-term interest rates to near zero and pushing long rates to historic lows. This has impacted captive insurance portfolios that strive to safely generate enough investment income to cover operating costs, maintain statutory reserves, and pay claims when needed. With new Fed chief Janet Yellen taking charge soon, most participants believe the key themes for 2014 will be timing of the Fed taper and how financial markets will react.

In these uncertain times, let's look for a lesson from Pimco's flagship Total Return fund, the world's largest bond fund, managing $244 billion as of the end of November. Last month marked the seventh straight month of outflows for the fund, an estimated $36.9 billion year-to-date and the biggest on record in a calendar year since 1987. Also, the fund is down 1.24% in total returns this year. While many media outlets have covered these topics recently, there is more to this story.

In Search of Yield

Daryl Jones, director of research at Hedgeye Risk Management, recently wrote in Fortune, “The broader issue with bond managers like Pimco is how far afield they have journeyed in search of yield. And therein lies the key question: At what cost does this hunt for yield come?”

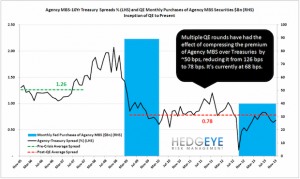

Hedgeye estimates that almost 34% of Pimco Total Returns holdings are in agency Mortgage Backed Securities (MBS). Look at the chart below comparing the spread of agency MBS to the 10-year Treasury Yield.

Prior to the financial crisis, this spread was around 126 basis points. It has now narrowed to approximately 68 basis points. In other words, the almighty chase for yield has effectively priced mortgage backed securities to one of the lowest levels of risk that we've seen in the asset class. Even if the spread for Agency MBS normalized by just 50 basis points, to pre-crisis levels, it would have a meaningful impact on the market. By our estimation, allowing for modified duration, a 50 basis increase (reversal of tapering for instance) in yield would lead to 5% downside in the Agency MBS market. The issue for firms like PIMCO is that a 5% correction in one of its more significant asset class exposures is likely to lead to continued underperformance and accelerated outflows. Outflows and decreased liquidity, of course, are only likely to exacerbate any move in price in the MBS market.

Remember, there is no free lunch. History is full of examples of how “chasing yield” can be a very costly investment mistake. Fixed income is supposed to be your safe money so safety should come first.

Let us not forget how we got to this zero interest rate environment in the first place. I bet all those investors who loaded up on “safe” sub-prime mortgage-backed securities for the extra yield wish they had done things differently.

photo credit: “Risk Key” by Got Credit is licensed under CC BY 2.0

What has your captive insurance company been doing to increase investment income? Are you chasing yield? Is it worth the risk?