Vanguard says no

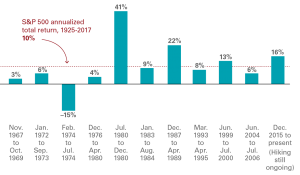

According to Vanguard, periods of rising rates have almost always coincided with a rising stock market. Looking back 50 years which includes 11 periods where the Fed raised rates, the market rose in 10 of the 11 periods.

The good news is that the average annualized return of the S&P 500 during those periods was 10.3%. This may come as a surprise, but remember the Fed typically raises rates when the economy is strong and corporate earnings are healthy. This is the case today.

Goldman raises caution

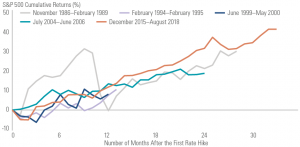

On the other hand, Goldman Sachs raises some caution stating “as we move further into the late stages of this economic cycle with less accomodative monetary policy and more regular rate hikes, we think pre-emptive risk management will be increasingly important.”

In the above chart, they show this rally is running longer from the first rate hike in comparison to the last four hiking periods. However, it is important to remember that the Fed has been very slow to hike rates with just one in 2015 and one in 2016. But we would echo their concern that this is getting late in the cycle and investors should err on the side of caution.

“High Interest Rate” by cafecredit is licensed under CC BY 2.0