Why This Episode Is a Must-Watch

The rules of retirement investing are changing. With alternative investments now making up over 12% of global portfolios, institutions like Harvard and Yale have long used private equity, hedge funds, and real assets to enhance returns and reduce risk. But just because you can, does it mean you should?

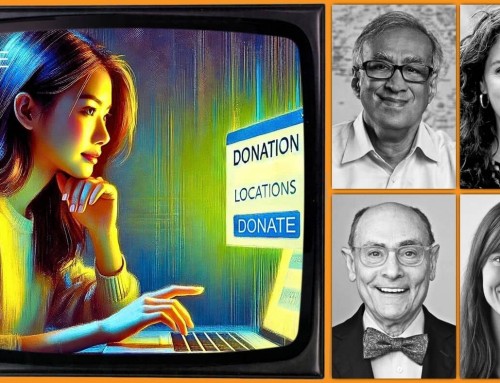

In this episode of Inspired Money, we explore real estate, alternative investments, digital currencies, ESG strategies, and risk management—uncovering different perspectives on whether these strategies truly belong in your retirement portfolio. Whether you’re rethinking your financial future or exploring new opportunities, this conversation will provide actionable insights to help you invest smarter.

Meet our Expert Panelists

Shana Sissel, CAIA, is the Founder and CEO of Banríon Capital Management Inc., specializing in alternative investments and portfolio solutions for financial advisors. Known as the “Queen of Alternatives,” Shana is a sought-after speaker and media contributor, leveraging her two decades of industry expertise and personal resilience to advocate for women in finance and demystify complex investment strategies.

Roger Whitney, the “Retirement Answer Man,” is a Certified Financial Planner with 27+ years in finance. Author of “Rock Retirement” and founder of the Rock Retirement Club, he's also the voice behind the popular Retirement Answer Man podcast that has over 8 million downloads.

Teresa Ghilarducci is a labor economist and retirement security expert, serving as the Bernard L. and Irene Schwartz Professor of Economics at The New School for Social Research, where she also directs the Schwartz Center for Economic Policy Analysis and the Retirement Equity Lab. Known for her influential work on pension reform, she proposed Guaranteed Retirement Accounts to address the retirement savings crisis, and has authored several books, including Rescuing Retirement, How to Retire With Enough Money, and Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy.

Richard Carey successfully built a substantial real estate portfolio that began while stationed in Germany and Korea. He managed to acquire over 20 properties and be debt-free. Today, he is retired from the military and living off the passive income generated by his 30+ properties. Rich is based in Montgomery, Alabama, where he’s a realtor, he manages his investments, and you can learn about building wealth through real estate on his TikTok and YouTube channels—Rich on Money.

Barbara Friedberg, MS, MBA, is a veteran portfolio manager, fintech consultant, and investing expert dedicated to simplifying wealth-building strategies. Author of Invest and Beat the Pros, Personal Finance: An Encyclopedia of Modern Money Management, and How to Get Rich Without Winning the Lottery, her work has been featured in U.S. News & World Report, Investopedia, and Yahoo Finance. Visit her YouTube channel and BarbaraFriedbergPersonalFinance.com for more information.

Key Highlights

Critique of the Current Retirement System

Teresa Ghilarducci stressed her concerns about the retirement crisis, largely attributing it to the shift towards individual retirement accounts, which she believes have been unsuccessful. She highlighted, “The median amount of retirement assets to supplement Social Security is zero.” Ghilarducci elaborated that for those with retirement accounts, the median amount is only $90,000—insufficient for a stable retirement. She argued that the existing 401(k) system has failed to provide adequate retirement savings for workers and called for a more robust, professionally managed system akin to pensions. Furthermore, Ghilarducci expressed apprehension about including alternative asset strategies in individual retirement accounts, emphasizing the challenges and risks associated with such a do-it-yourself approach.

The Role of Alternative Investments

Shana Orczyk Sissel discussed the potential benefits of including alternative investments in retirement portfolios, albeit with proper education and sizing. She noted, “The evidence suggests that a 20% allocation in that space…is kind of the optimal way to do it.” Sissel highlighted that these alternatives, such as managed futures and option strategies, can offer significant diversification and risk management benefits, challenging the idea that only traditional investments should be used.

Simplicity in Retirement Planning

Roger Whitney, the Retirement Answer Man, emphasized the importance of simplicity in retirement planning, advocating for a straightforward approach over the complexity of alternative investments. He stated, “What are you trying to solve for first? If you are at retirement, you're trying to solve to meet the liabilities of your spending over a period of time. You're not trying to solve for alpha.” Whitney cautioned that the increasing availability of alternative investments is often just marketing, adding unnecessary execution risks to portfolios. He suggested that many retirees would benefit from focusing on simpler, more manageable investment strategies.

Personal Success with Real Estate

Rich Carey shared his motivation behind investing in real estate, which was driven by his 20-year career in the military. While many perceive the military as a stable path leading to a pension after 20 years, Carey noticed periodic downsizings every four to five years, where personnel could be abruptly let go. He expressed his concern about potentially being discharged before completing his 20 years and missing out on the military pension. To safeguard his financial future, Carey began building a real estate portfolio to generate passive income. This way, even if he wasn't able to secure a military retirement, he would still have a stable income stream to rely on as he transitioned back into the civilian workforce.

Barbara Friedberg: Fees and Risks in Alternative Investments

Barbara Friedberg raised significant concerns regarding the fees and risks associated with alternative investment products, particularly those available through newer crowdfunding apps. She cautioned, “Look at the fees because fees are inversely correlated with returns. And typically hedge funds have huge fees.” Friedberg stressed the importance of understanding the underlying products and potential losses, emphasizing that high fees can severely impact returns and should be a key consideration for investors.

Call-to-Action

Take a look at your current retirement plan and identify one area where you could diversify. Whether it's adding a bit of real estate exposure, exploring ESG investments, or looking into digital assets, make it a point to start researching options. Even a small change can make a big difference over time.

Find the Inspired Money channel on YouTube or listen to Inspired Money in your favorite podcast player.

Andy Wang, Host/Producer of Inspired Money