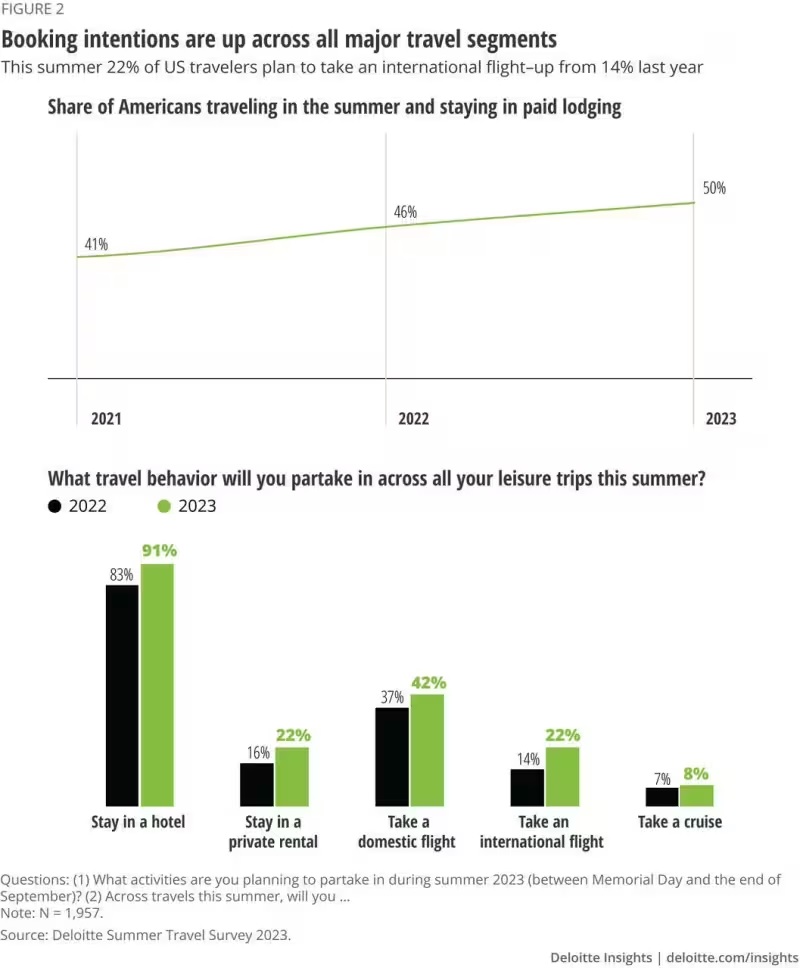

With school out for summer, many Americans are ready for their summer holidays which often include travel. There is still an element of COVID revenge travel as many travelers make up for those canceled 2020 trips.

When looking more deeply at the trends, it is evident that the divide between high and low income spenders has widened in this time of high inflation.

This summer, the wealthy are increasingly spending on trips while lower earners are pulling back, according to a recent NBC news article.

Upcoming Travel Trends

Among households earning more than $100k annually, 81% are planning to take summer vacations, up from 75% last year according to Bankrate. On the other hand, for those making less than $50k, just 54% are planning summer vacations, down from 56% a year ago.

To combat higher inflation and tighter budgets, 26% of people plan to drive rather than fly to destinations this summer, up from 16% last year. Furthermore, 29% of travelers are choosing cheaper accommodations or destinations, up from 22% last year. Sadly, 26% will be traveling fewer days, up from 19% last year.

It isn't surprising to see this type of change in spending habits. Inflation has hurt consumer wallets in a big way. Many have turned to credit cards as companies like Capitol One and Discover Financial have reported 20% increases year over year in their loan books. This comes at a big cost as the average annual percentage rate (APR) now tops 21%!

We hope you have a great summer holiday and enjoy time with family and friends!

Feature image from Unsplash