When it comes to investing, valuable conventional wisdom abounds:

- “Invest early and often.”

- “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” – Warren Buffet

- “Time in the market beats timing the market.” – Ken Fisher

Despite many great quotes, the impact that market downturns can have on mental health is less often discussed. Because May is Mental Health Awareness Month and we believe that a financial hurricane has begun, it is important to consider protecting your financial health as well as your mental and physical health.

I have personally seen how falling stock prices can affect both mental and physical health. For example, a retired executive came to us after his investment portfolio had dropped by over 40% during the Financial Crisis of 2008. Sadly, six months later he was diagnosed with aggressive cancer and passed away. While his terminal illness cannot be connected to the performance of his investment portfolio with certainty, I cannot help but think that the extraordinary emotional and financial trauma took its toll. He had told me many times that he blamed himself for not paying closer attention and not talking to his previous advisor about the importance of preserving his retirement nest egg. Regret has been shown to damage mental health.

Other times, the connection between the stock market and mental health is direct. A friend who was a successful professional trader had bet that the market would go down. His timing was early and he incurred significant losses. Ultimately, he was right, but the market correction that he had forecasted did not come until three months later. Tragically, his near-term trading losses were too much resulting in severe depression and him taking his own life. These are just two examples of ways the stock market can negatively impact one's health.

There is data that supports a close connection between financial and mental health.

- Based on statistics reported by Galbraith in The Great Crash 1929, the suicide rate in the United States increased from 17.0 per 100,000 people in 1929 to 21.3 in 1932, the worst of the financial calamity. (History Channel)

- Worries about finances came in as the No. 1 stressor in a CreditWise survey citing finances are the No. 1 cause of stress (73%) – being reported as a major cause of stress more often than politics (59%), work (49%) and family (46%). (Purdue University)

- In an 11-year study to examine a potential relation between stock market volatility and mental disorders, a report from Taiwan showed that a 1000-point fall in the stock price index (which was about two-thirds of its standard deviation) resulted in increased hospitalizations for mental disorders by the magnitude of 5.32% for men and by 3.81% for women.

While stock ownership is one of the most powerful ways that people can accumulate wealth, it can also increase mental disorders and hospitalizations.

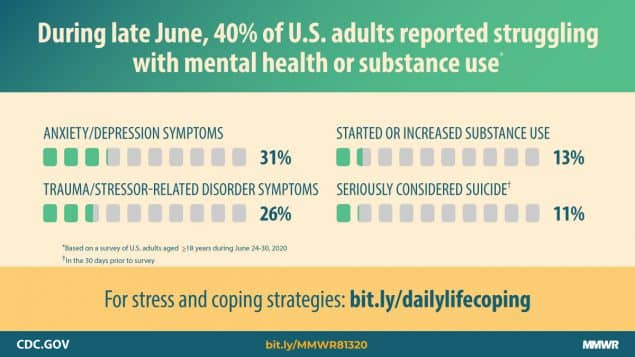

Compounding mental health issues, the global pandemic increased the severity of symptoms. A June 2020 Center for Disease Control (CDC) report showed considerably elevated adverse mental health conditions associated with COVID-19.

Many factors can influence your mental health. It is important to identify things that you do not have control over and do the best you can with the resources available to you. It is important to connect with others. Talk with people you trust about how you are feeling, your financial concerns, or how external factors are affecting you.

Every individual and their investment objectives are unique, but the data suggests that it's not always easy to weather the financial storm. Severe declines in net worth can have serious side effects so there can be benefits to de-risking your investments when risks are high.

When it comes to your investments, it is important to realize that you can always change strategies. We frequently provide portfolio reviews and second opinions. Whatever your approach, be sure to make time to take care of your mental health and your money.

Helpful links:

How have your personal finances ever hurt your mental health?