Service Sector | Asset Protection | Large Cap Growth | Captive Insurance

Index Equity Plus® strategy

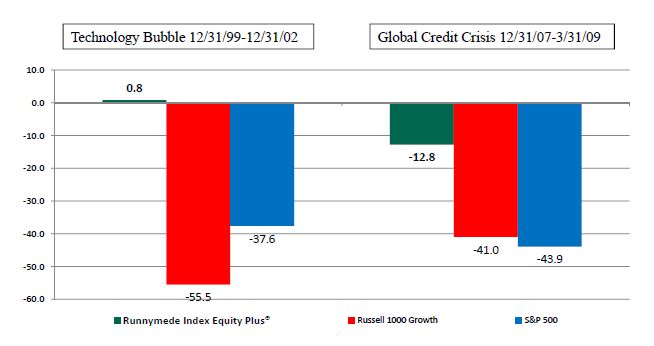

Runnymede's Index Equity Plus® strategy is designed to deliver quality growth with less volatility by side stepping major market downturns. Runnymede professionals protected client assets in the major bear markets of 1987, 2000, and 2008.

Please watch this 3-minute video to learn why we believe that To Win is Not to Lose.

Index Equity Plus® strategy highlights:

- Our proprietary risk control discipline is used by Runnymede's investment team to actively manage portfolio holdings and asset allocation.

- Diversified portfolios are constructed with exchange traded funds (ETFs) and instruments providing exposure to U.S. and non-U.S. securities.

- In major bear markets, Runnymede protects client assets by increasing fixed income exposure in client accounts.

To Win Is Not To Lose

Please Note: The above is not exhaustive of all market events and corresponding Runnymede positions. Runnymede has been both correct and incorrect as to various market-related event over the past 3 decades. As indicated above, Runnymede did outperform during the last two bear markets. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Runnymede Capital Management), will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request.

Contact us to learn more about our performance history, methodology, and if Index Equity Plus® fits into your investment portfolio.